For the second time this year, the Canadian Real Estate Association has downgraded its forecast for home sales in 2025, even as it says a turnaround could be looming following increased activity in June.

Sammy Hudes, The Canadian Press Jul 15, 2025 1:12 PM

For the second time this year, the Canadian Real Estate Association has downgraded its forecast for home sales in 2025, even as it says a turnaround could be looming following increased activity in June.

The association reported that the number of homes changing hands across the country in June rose 3.5 per cent compared with a year ago. Canadian home sales last month also increased 2.8 per cent compared with May on a seasonally adjusted basis.

In its outlook released Tuesday, CREA said it now expects a total of 469,503 residential properties to be sold this year, a three per cent decline from 2024. In April, the association forecast the number of home sales for 2025 to remain essentially unchanged from last year, which itself marked a steep cut from its January forecast of an 8.6 per cent year-over-year increase.

The national average home price is forecast to fall 1.7 per cent on an annual basis to $677,368 in 2025, which would be around $10,000 lower than predicted in April.

CREA senior economist Shaun Cathcart said that despite a "chaotic start to the year," the latest data suggests the housing market rebound originally forecast for this year — before it was upended by the Canada-U.S. trade war — may have "only been delayed by a few months."

“At the national level, June was pretty close to a carbon copy of May," said Cathcart in a press release, cautioning "we’re not out of the woods yet" given U.S. President Donald Trump's latest 35 per cent tariff threat.

The association said the tariff-related uncertainty that drove so many buyers back to the sidelines earlier this year ended up taking a larger bite out of activity in B.C., Alberta and Ontario than was expected three months ago, but "the good news is markets appear to be entering their long-expected recovery phase, fuelled by pent-up demand, lower interest rates, and an economy that is expected to avoid worst-case tariff scenarios."

“Most housing markets continued to turn a corner in June, although market conditions still vary considerably depending on where you are in Canada,” said CREA chair Valérie Paquin.

“If the spring market was mostly held back by economic uncertainty, barring any further big shocks, that delayed activity could very likely surface this summer and into the fall."

CREA said it now forecasts national home sales in 2026 to improve by 6.3 per cent to 499,081. That would put activity back on track with what was expected in its April forecast, when it predicted a 2.9 per cent gain in sales next year.

The national average home price is expected to increase three per cent from 2025 to $697,929 next year.

Meanwhile, the national average sale price fell 1.3 per cent in June compared with a year earlier to $691,643.

There were 47,871 home sales recorded last month, up from 46,237 in June 2024. The association said the recovery in sales activity over the past two months was led overwhelmingly by the Greater Toronto Area.

Still, activity remains slower than usual, said Cameron Forbes, a Toronto-area broker and general manager at Re/Max Realtron Realty Inc.

"The uncertainty of the Trump tariffs and the impact on, certainly in Ontario, the manufacturing context and everything, still has a lot of buyers on the sidelines that probably shouldn't be," said Forbes in an interview.

"It's still a market where I think buyers are unfortunately a bit uncertain. Many of them who have jobs, who have security of those jobs, who have equity in homes, that would be a great time for them to make a trade to a preferred location or a larger home for their family, but they are looking at the headlines and seeing the uncertainty related to tariffs."

The number of newly listed properties throughout the country was down 2.9 per cent month-over-month from May. A total of 206,435 properties were listed for sale by the end of the month, up 11.4 per cent from a year earlier and just one per cent below the long-term average for this time of the year.

"June's sales performance came in broadly as expected, with Canadian transactions continuing their gradual recovery from their early-year depths," said TD economist Marc Ercolao in a note.

"We expect home sales will continue to rise in the second half of the year as pent-up demand continues to trickle into the market. That said, the sales level should remain subdued as economic uncertainty remains elevated, especially with Canada facing new tariff threats."

BMO senior economist Robert Kavcic said there are three major factors still holding back the housing market, including a "sluggish" job market being aggravated by the trade war. With the Bank of Canada holding its key policy rate steady, he said mortgage rates of around four per cent are also "not low enough to improve the affordability calculus in a demand-sparking way."

"And, market psychology now appears bearish," said Kavcic in a note.

"Just as expectations of higher prices drove accelerating gains on the way up, the understanding that prices are falling is holding back buyers on the way down in some locations."

Forbes added that much is riding on the outcome of ongoing trade negotiations between Canada and the U.S., which currently hold an Aug. 1 deadline. Reaching a compromise could prompt buyers to return, leading to a more "healthy market," he said.

But failing to reach an agreement on time would mean further uncertainty in the housing market, he said.

"If that's the case, then we'll continue to have fewer sales for at least the next three or four months until the impacts of whatever comes to fruition are better known."

Contact us for a Free Home Evaluation.

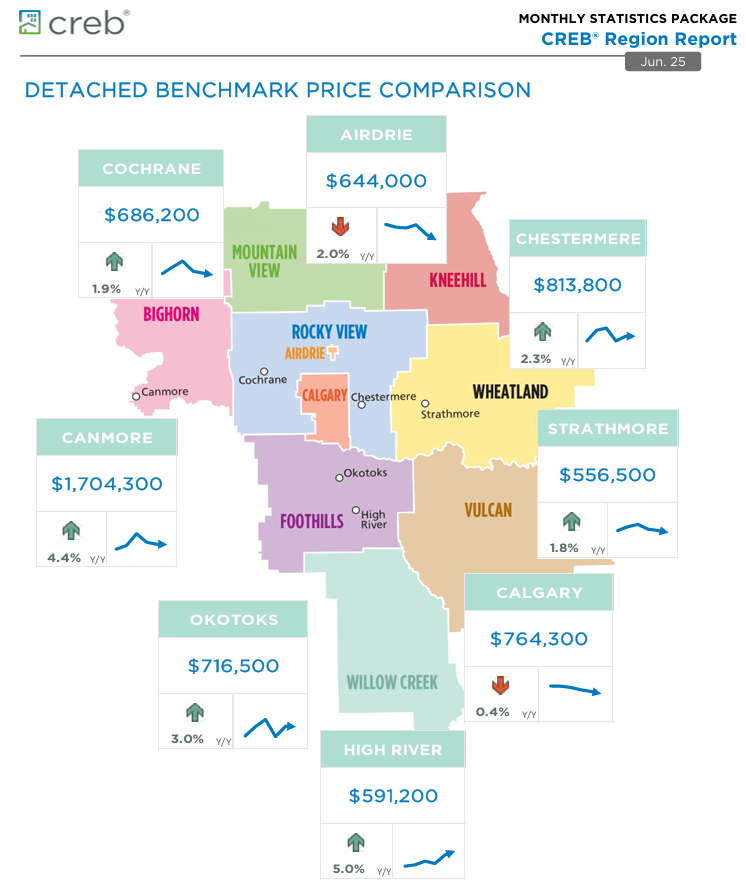

独立屋市场亮点分析

独立屋市场亮点分析 趋势判断

趋势判断