Canadian real estate markets demonstrated remarkable resilience in 2012—with home sales up or on par in 65 per cent of major centres—despite considerable headwinds in terms of tighter financing and economic uncertainty abroad. The trend is expected to continue, with home-buying activity propped-up by low interest rates and an improved economic picture in 2013, according to a report released today by RE/MAX.

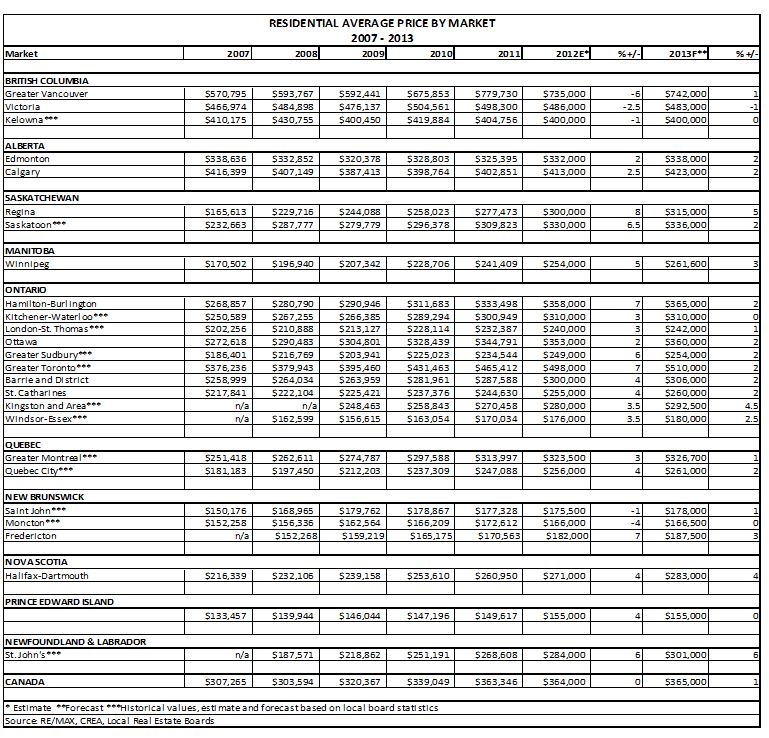

The RE/MAX Housing Market Outlook 2013 examined trends and developments in 26 major markets across the country. The report found that the number of homes sold is expected to match or exceed 2011 levels in 65 per cent of markets (17/26) in 2012, led by strong activity in Western Canada, including Calgary (up 13.5 per cent) and Regina (eight per cent). Eighty-one per cent (21/26) of markets are set to experience average price increases by year-end 2012, with Regina the country’s frontrunner at eight per cent, followed by Hamilton-Burlington, Greater Toronto, and Fredericton at seven per cent and Saskatoon at 6.5 per cent. The forecast for 2013 shows the upward trend moderating, but values still ahead of 2012 levels in 85 per cent (22/26) of centres. Stability is forecast to characterize Canadian real estate in the new year, with sales above or on par with 2012 levels in 81 per cent (21/26) of markets.

Nationally, an estimated 454,000 homes will change hands in 2012, falling one per cent short of the 2011 level of 456,749. Canadian home sales are expected to almost mirror the 2012 performance next year, holding steady at 454,000 units. The average price of a Canadian home is expected to remain stable at $364,000 in 2012—on par with the figure reported in 2011. Values are expected to appreciate nominally in 2013, rising to $366,500, one per cent above year-end 2012 levels.

“Looking forward, there are a number of factors on the horizon that will serve to bolster residential activity in 2013,” says Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada. “Canada’s economic performance is expected to show signs of improvement, particularly in the latter half of the year, which should bode well for housing markets across the country. Historically low interest rates will also continue to drive healthy home-buying activity, especially in the move-up segment. Last, but certainly not least, there’s no denying the universal appeal of bricks and mortar. Canadians believe in homeownership. The stability of real estate over the long-term continues to fuel its appeal.”

The report found that low interest rates were a major impetus in 2012, fuelling sales of homes across the board. Tight inventory levels also factored into the equation early in the year, causing a flurry of activity in many centres. By mid-year, however, the third round of CMHC mortgage tightening had a noticeable impact on housing markets, pushing homeownership beyond the grasp of many first-time buyers.

The RE/MAX Housing Market Outlook Report also identified several regional disparities. Most notable was the pull back in sales activity in Greater Vancouver. A banner 2011 year and a slowdown in investor activity contributed to the trend in 2012. Yet, moderation was more widespread in the east, with half of Ontario and Atlantic Canada markets (8/16) reporting 2012 sales off the 2011 pace. Strength was evident throughout Saskatchewan, Alberta, and Nova Scotia, where exceptionally sound economic fundamentals drove demand. The Prairies also stood out in price appreciation, along with the Atlantic Provinces in 2012, and a repeat is on tap for next year. In 2013, Vancouver will rebound to post the strongest sales gain, while the Quebec markets post the sharpest decrease.

“Despite all the negativity surrounding residential real estate, the sky is not falling,” says Gurinder Sandhu, Executive Vice President and Regional Director, RE/MAX Ontario-Atlantic Canada. “Home sales have moderated, but remain within healthy levels. Greater optimism is expected to return next year, as the economy marks further improvement. Canadians appear to be reigning in their spending, heeding cautionary statements by the country’s financial leaders. We believe that will only serve to shore up the already healthy framework of the Canadian housing market in 2013.”

While first-time buyers will continue to have a significant presence in the overall marketplace, they are expected to take a back seat in 2013 in Canada’s largest markets—with move-up buyers the new engine driving home-buying activity. The greatest advance in home sales is expected in Vancouver (12 per cent), Calgary (10 per cent), Halifax (five per cent), Kingston (4.5 per cent) and Saint John (four per cent). The strongest upward momentum in average price in 2013 is forecast for St. John’s (six per cent), Regina (five per cent), Kingston (4.5 per cent), and Halifax (four per cent), followed by Fredericton and Winnipeg at three per cent. More balanced market conditions are expected in 2013 throughout the majority of markets, with supply meeting demand.

“The long-term outlook for Canadian real estate remains strong,” says Sylvain Dansereau, Executive Vice President, RE/MAX Quebec. “It has proven so in the past, and it will ring true in the years to come. Canada’s major centres are evolving at a tremendous pace and gaining traction on the world stage. As we look forward, our communities will certainly be more vibrant, more sustainable, while our housing mix focuses on density and diversification. The sheer number of developments planned or underway is staggering. We know the market ebbs and flows—that’s cyclical—but the future for real estate remains quite promising.”

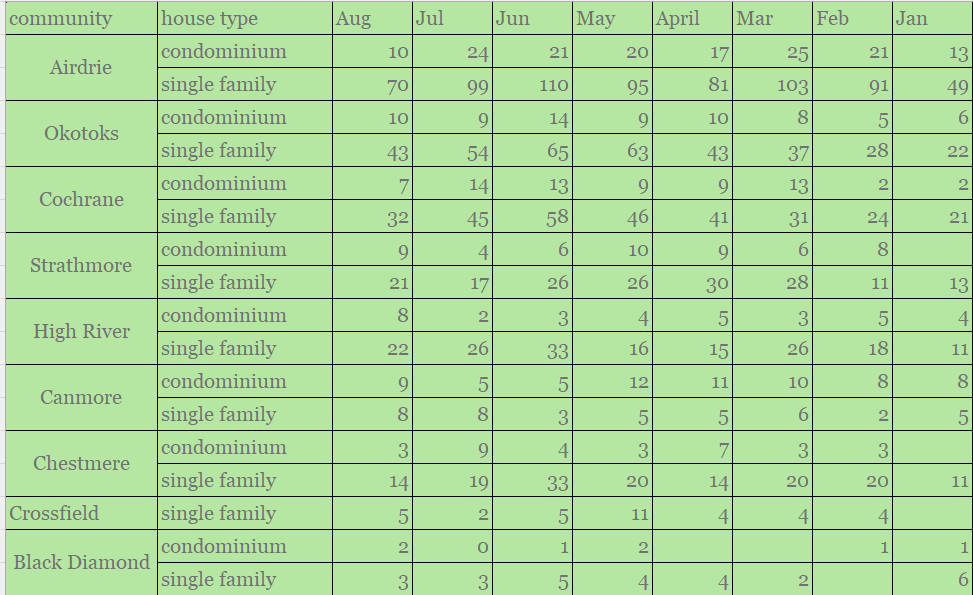

Immigration and population growth will continue to support housing demand moving forward. The Canadian government’s commitment to immigration will hold steady, with the country set to welcome as many as 265,000 immigrants in 2013. The greater focus on economic immigrants is already leading to quicker household formation and homeownership than in years past. These two factors will also support the burgeoning condominium segment—along with Canada’s aging population—while the desire for tangible assets props up the upper-end.