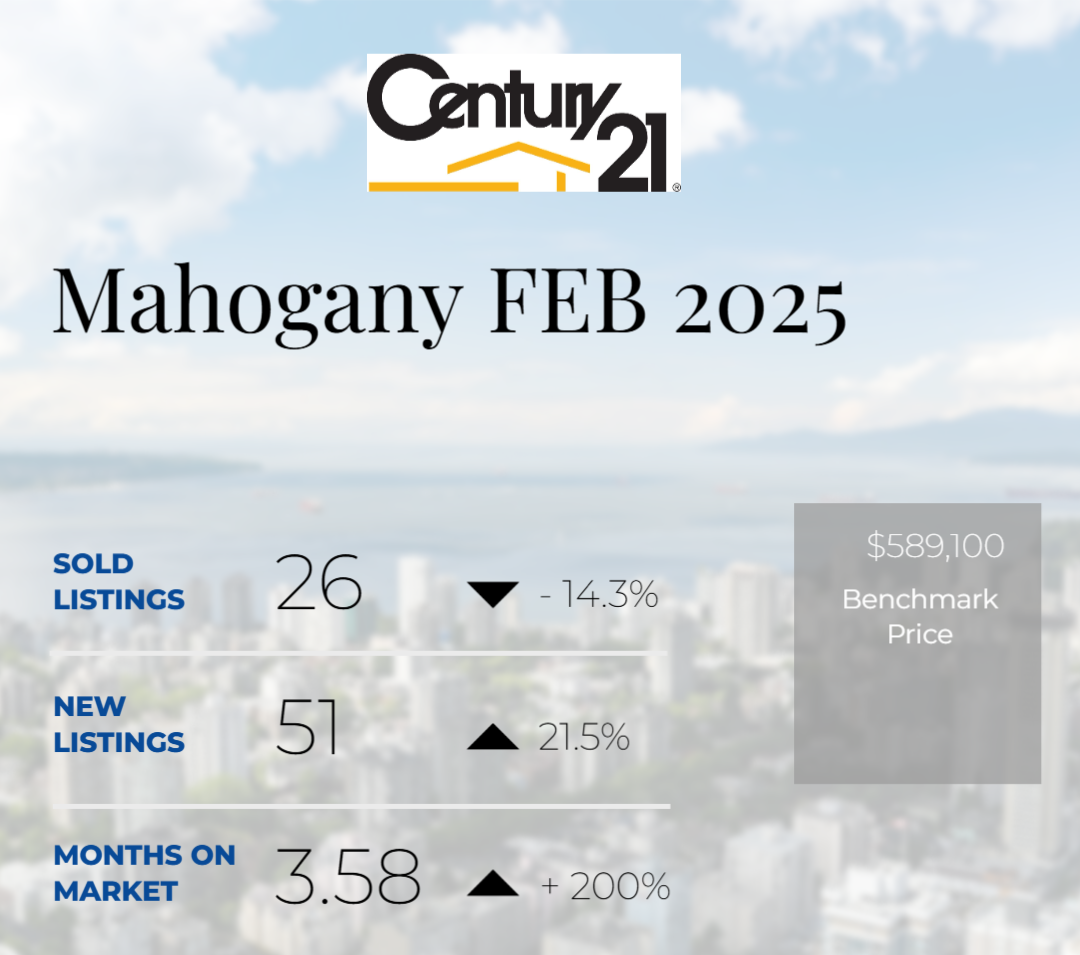

The Mahogany real estate market experienced shifts in February 2025, with a mix of price increases and a decline in sales compared to the previous year. Despite a slowdown in transactions, inventory levels increased, providing more choices for buyers.

Total Residential Benchmark Price: $589,100 (↑1.5% YoY)

Total Sales: 26 (↓45% YoY)

New Listings: 51 (↓9% YoY)

Inventory: 93 homes (↑66% YoY)

Months of Supply: 3.58 (↑200% YoY)

Property Type Breakdown

Detached Homes

Benchmark Price: $822,400 (↑2.3% YoY)

Sales: 16 (↓27% YoY)

New Listings: 27 (↑4% YoY)

Inventory: 38 homes (↑67% YoY)

Semi-Detached Homes

Benchmark Price: $579,600 (↑2.3% YoY)

Sales: 2 (↓78% YoY)

New Listings: 8 (No change YoY)

Inventory: 10 homes (↑89% YoY)

Row Homes

Benchmark Price: $487,500 (↑1.5% YoY)

Sales: 1 (↓80% YoY)

New Listings: 4 (↓50% YoY)

Inventory: 17 homes

Apartments

Benchmark Price: $362,200 (↑3.6% YoY)

Sales: 7 (↓36% YoY)

New Listings: 12 (↓14% YoY)

Inventory: 28 units (↑58% YoY)

Market Trends & Insights

Sales Decline: The 45% drop in total sales compared to February 2024 suggests a cooling in demand, possibly due to affordability concerns and higher mortgage rates.

Rising Inventory: A 66% increase in available homes indicates a shift toward a buyer’s market, providing more options and reducing competition.

Months of Supply Surge: The months of supply jumped by 200%, signaling a slower market where properties are taking longer to sell.

Stable Prices: Despite the sales decline, benchmark prices remained relatively stable or saw modest growth, reflecting continued demand for well-priced homes.

Looking Ahead

With inventory on the rise and fewer sales, Mahogany’s real estate market may favor buyers in the coming months. Sellers should price competitively to attract interest, while buyers can take advantage of increased selection and negotiation opportunities.

Contact us for a Free Home Evaluation.

For the latest community market report, SIGNUP HERE.

Comments:

Post Your Comment: