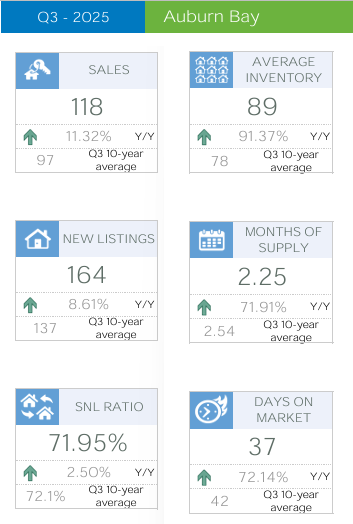

Total sales: 118 — up 11.3% year-over-year.

New listings: 164 — up 8.6% Y/Y; sales/new-listings (S/NL) ratio ~72%, indicating a still-active market with solid absorption of new supply.

Benchmark price: $620,867, down ~3.5% Y/Y; Median price: $545,500; Average price: $593,235.

Average days on market (DOM): 37 days

Market trends by property type

Detached

Sales: 54 (largest share of Q3 sales).

Benchmark price (detached): ~$804,300; median detached price ~$748,650. Detached benchmark shows small Q/Q and Y/Y movements but remains the highest among types.

Trend: Detached homes continue to lead sales by volume and price; market remains competitive compared with other types, though benchmark has softened modestly Y/Y.

Semi-detached

Sales: 13

Benchmark price: $524,600

Trend: Smaller sales volume but stronger price stability — semi-detached prices near mid-market and showing modest annual change.

Row (townhouse)

Sales: 15

Benchmark price: $455,233

Trend: Townhomes remain an important mid-price option; inventory and months-of-supply indicate buyers have more choice than for detached product.

Apartment

Sales: 36

Benchmark price: $351,500

Trend: Apartment product represents the entry price point for many buyers; benchmark and median are considerably lower than other types, supporting demand from first-time and downsizing buyers.

Inventory & market balance

Average inventory: 89 active listings and months of supply ≈ 2.25 months — a sellers’/balanced leaning market (under ~3 months typically indicates tighter conditions).

S/NL ratio ~72% — shows strong absorption of newly listed stock, keeping upward pressure on prices in pockets despite a modest Y/Y benchmark decline.

Buyer / seller signals

Faster turnover suggests buyers are still active — however benchmark price decline Y/Y (-3.5%) indicates some price pressure overall, likely reflecting broader market conditions (higher borrowing costs, seasonal shifts, or more supply in certain price bands).

Price segmentation: Detached remains highest-priced; apartments and row units provide more affordable entry points — expect continued demand for mid/affordable price ranges.

Quick takeaways for sellers / buyers

Sellers: Proper pricing still matters — strong S/NL ratio and DOM ~37 means well-priced homes move; detached properties command the top dollar.

Buyers: More choices in apartment/row segments and slightly softer benchmark prices create opportunities for negotiation, especially off-peak or in higher inventory price bands.

Investors: Months of supply (~2.25) and S/NL near 72% show continued demand; monitor mortgage-rate developments and vacancy/condo supply if pursuing apartments.

Contact us for a Free Home Evaluation.

Comments:

Post Your Comment: