McKenzie Lake experienced a strong and competitive market in Q1 2025, driven by limited inventory and continued demand from buyers seeking established communities with lake access and family-friendly amenities. The market leaned towards seller-friendly conditions, particularly in the detached home segment.

Benchmark Price: $659,933

▲ 3.4% year-over-year increase

▲ 0.4% quarter-over-quarter increase

Total Sales: 30

New Listings: 42

Inventory: 18

Sales-to-New Listings Ratio: 71%

Months of Supply: 1.8 (indicative of a tight market)

Days on Market: Average of 20 days

🏘️ Market Trends

🔹 Detached Homes

Strongest performing segment in McKenzie Lake.

Benchmark price: $692,567

▲ 3.9% year-over-year

▲ 0.4% quarter-over-quarter

High demand driven by families seeking space, yards, and access to the private lake and recreational amenities.

Low inventory has created upward pressure on prices.

🔹 Semi-Detached

Benchmark price: $574,467

▲ 4.4% year-over-year (highest appreciation among all types)

▼ 0.2% quarter-over-quarter

Price growth has been robust year-over-year, though there was a slight correction from the previous quarter.

Popular among downsizers and couples looking to stay in the area without maintaining a large property.

🔹 Row (Townhomes)

Benchmark price: $409,367

▲ 4.3% year-over-year

▲ 0.2% quarter-over-quarter

Strong interest from first-time buyers and investors.

Represents one of the most affordable entry points into the McKenzie Lake market.

🔹 Apartment Condos

Benchmark price: $290,800

▲ 8.0% year-over-year

▲ 2.5% quarter-over-quarter (largest Q/Q increase)

Demand has surged due to affordability and low vacancy rates in Calgary’s rental market.

Attracts singles, seniors, and investors seeking lower-maintenance living.

📰 McKenzie Lake Real Estate News & Trends

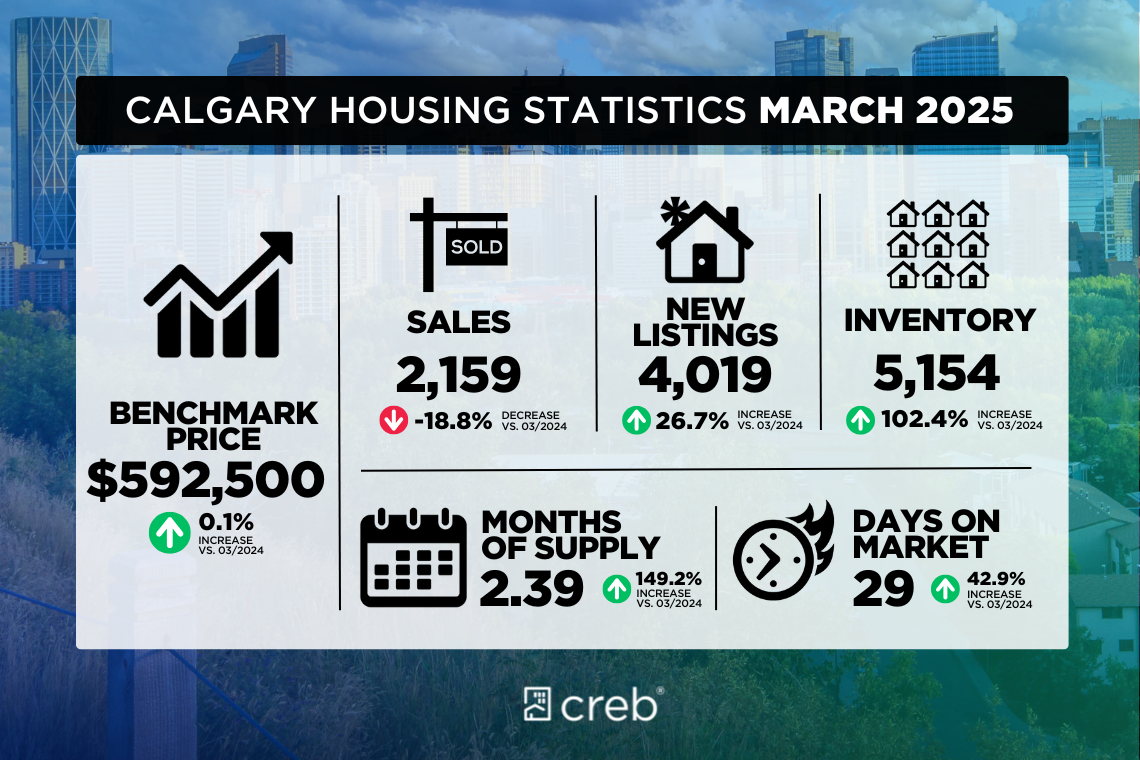

Calgary’s housing market remains active with limited supply and high competition, especially in the Southeast.

Mortgage rate expectations for possible cuts later in the year have encouraged more buyers to enter the market early.

McKenzie Lake's desirability is enhanced by lake privileges, proximity to Fish Creek Park, top-rated schools, and access to Deerfoot and Stoney Trail.

🎉 Community Past Events & Highlights

Winter Fest at McKenzie Lake Beach Club: Hosted in February, this annual event drew strong community participation with ice skating, fire pits, and family activities, reinforcing the area's strong community spirit.

Neighbourhood Watch Expansion: Community involvement has increased with new safety initiatives and better lighting in public areas.

School Enrollment Growth: Local schools like McKenzie Lake School and Mountain Park School reported increased registrations, suggesting continued family migration into the area.

📌Expectations remain positive heading into spring:

Increased listings typical of the season may slightly ease pressure on buyers.

Price growth is likely to continue modestly, especially for detached and apartment-style properties.

Investor interest in apartment condos and townhomes is expected to grow further as Calgary remains a top Canadian destination for migration.