Posted on

April 2, 2018

by

Team Jillain

Prices remain stable compared to last year

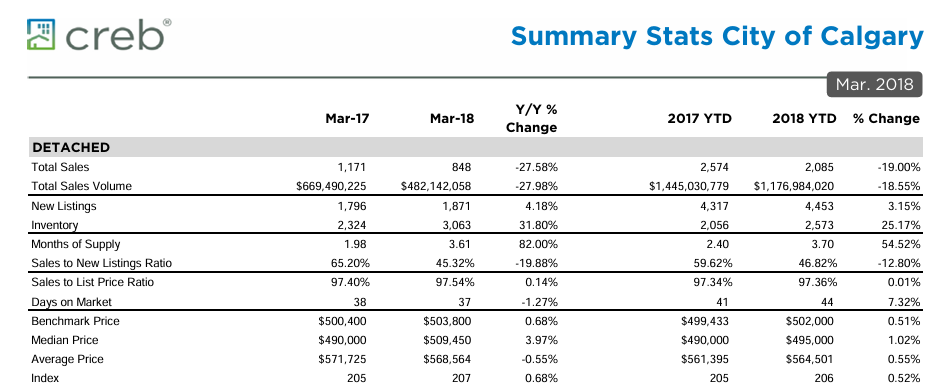

Calgary, April2, 2018–As expected, slow sales this quarter have persisted through March in the City of Calgary. This is not a surprise, after stronger growth in sales at the end of last year following the announced changes to the lending market. First quarter sales totaled 3,423 units, nearly 18 per cent below last year’s levels and 24 per cent below long-term averages. Easing sales and modest gains in new listings caused inventories to rise and months of supply to remain above four months. “Economic conditions are slowly improving, but it has not been enough to outpace the current impact of higher lending rates and more stringent conditions,” said CREB® chief economist Ann-Marie Lurie.

“We are entering the most active quarters in the housing market with more inventory, which could create some price fluctuations. However, the improving economy is expected to prevent overall prices from slipping by significant amounts.”

While prices trended down on a quarterly basis, they remained relatively unchanged over last year’s levels due to modest gains in the detached sector offsetting declines in the apartment sector. The citywide benchmark price for detached product averaged $502,000 in the first quarter. This is slightly lower than the fourth quarter of last year, but comparable to levels recorded in the first quarter of last year. In March, the detached price reached $503,800, 3.6 per cent below pre-recession highs, but one per cent above the lows recorded during the recession.

“The market today is better than what we experienced at the peak of the recession,” said CREB® president Tom Westcott. “You can find good value if you’re looking to buy a home, and you can also get good value if you’re selling. Being well-informed, in any economic condition, is the key, because there are differences in the market depending on what type of property it is and where it is located.”

Detached market inventories in the first quarter of 2017 were low compared to historical standards. This year, detached inventories have averaged 2,573 units over the first quarter, 10 per cent below first quarter averages recorded during 2015 and 2016. Spring will have more inventory than last year, slowing progress on price recovery. However, the amount of price adjustment will vary depending on competing supply by location and product type.

HOUSING MARKET FACTS

• While detached benchmark prices eased by 0.25 per cent over the previous quarter, the quarterly decline was not consistent across all areas. Prices were stable in both the south and south east districts, while in the city centre, prices improved over the previous quarter.

• Despite the recent easing of new listings, the apartment condominium sector continues to struggle with excess supply in the resale, new-home and rental market. This is impacting prices. Condominium apartments averaged $256,567 in the first quarter, one per cent below the previous quarter and three per cent below levels recorded in the first quarter of 2017. Overall, monthly apartment prices are over 14 per cent below the highs recorded in 2014.

• Year-over-year, attached price changes have ranged from growth of four per cent to declines of 3.7 per cent depending on the sector of the city. Prices improved in the city centre, north west and south east districts of the city. However, those gains were offset by the losses in the north east, north, west, south and east districts. Attached benchmark prices averaged $328,533 in the first quarter and remain unchanged from levels recorded at this time last year.

• Activity within the attached sector continues to vary based on row product versus semi-detached. Semi-detached prices remained relatively stable compared to last year and last quarter, thanks to recent improvements in the city centre district. Meanwhile, row prices eased slightly over the previous quarter, with prices easing across all districts compared to the fourth quarter of 2017.